Global business software industry database is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

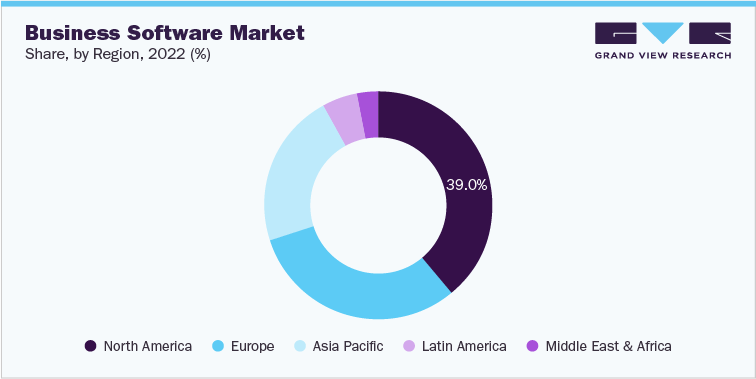

The global business software market was estimated at USD 71.11 billion in 2022 and is anticipated to increase at a CAGR of 11.3% from 2023 to 2030.

Event Management Software Market Growth & Trends

The global event management software market size was valued at USD 6.96 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.1% from 2023 to 2030. The market growth can be attributed to the managed professional service providers' steadily increasing popularity for professional event management that simultaneously manages security concerns. Additionally, the demand for event management software has been boosted by expanding cultural events such as social gatherings, charity events, and fundraising activities, including those planned by SMEs for marketing purposes. For instance, in June 2022, Stova acquired Eventcore, an event registration service provider. Through this acquisition, Stova was positioned as the leading event platform for providing advanced and memorable experiences throughout the full event lifecycle. With the capacity to carry out complicated registration, including Eventcore in the Stova brand portfolio will strengthen the company's robust event management solution and reinforce the company's commitment to offering customers end-to-end solutions.

Advanced analytics, a broad framework of insightful technologies and methodologies designed to help find patterns and trends, find solutions, precisely predict the future, and drive innovation through data-driven and fact-based information, is being used by manufacturers in the management software industry. This trend is gaining traction in the current market and is fostering the growth of the event management software market. Furthermore, the usage of cloud-based event management software is growing. This solution allows experts to leverage their expertise by incorporating reliable connectivity features through apps. These factors are expected to boost the adoption of event management software.

ERP Software Market Growth & Trends

The global ERP software market size was valued at USD 54.76 billion in 2022 and is expected to expand at a CAGR of 11.0% from 2023 to 2030. Increasing demand to streamline business processes with a single integrated solution, reducing turnaround time, and enhancing customer satisfaction by seamlessly integrating with customer relationship management (CRM) software is expected to drive the demand for ERP software solutions. For instance, in September 2022, Ramco Systems, an ERP software provider, partnered with OpenWorks, a facility management software provider based in the U.S. Ramco ERP Software offers OpenWorks a single integrated platform that includes modules for enterprise asset management, facility management, finance, fixed assets, sales, and purchases. The company maximizes efficiency by automating payments, customer billing, asset tracking, franchisees, and franchise assignment processes.

COVID-19 impacted the supply chain in businesses and various industries' spending on enterprise resource planning (ERP). Multiple industries successfully utilized cloud-based services to build a robust system that regulates the business. For instance, in May 2022, Epicor, an ERP software provider, released Epicor Industry ERP Cloud, which includes updates for Epicor Prophet 21 for distribution, Epicor Kinetic for manufacturing, and Epicor BisTrack for construction. With the new updates, the company would continue supporting the people-centric, open, and connected industry productivity solutions essential to businesses.

Order your copy of Free Sample of “Business Software Industry Data Book - Event Management Software, ERP Software and Quality Management Software Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Quality Management Software Market Growth & Trends

The global quality management software market size was valued at USD 9.37 billion in 2022 and is expected to grow at a CAGR of 10.6% from 2023 to 2030. Increased regulatory compliance requirements, a higher focus on digital transformations, and higher customer expectations are driving the need for faster response times to change. In turn, these factors encourage organizations to adopt reliable quality management solutions. For instance, in June 2022, QIMA, a supply chain quality and compliance solutions provider, and CBX Software, a product lifecycle management platform provider, collaborated to develop an integrated supply chain inspection solution that streamlines quality inspections for brands and retailers. With this partnership, CBX Cloud extends seamlessly to QIMA's trusted inspections directly from CBX Cloud. Moreover, users can access instant inspection reports and analyses generated by QIMA through CBX Cloud. As the company's flagship software platform, CBX Cloud enables retailers to automate workflows and manage supply chains efficiently-from product development to sourcing, to order processing.

Scalability is one of the most important features of quality management software. It allows accommodating a wide range of operations and sizes and tailoring them to meet the unique needs of organizations. In November 2022, Bentley Systems Incorporated, an infrastructure engineering Software Company, announced new features of the iTwin Platform. The iTwin Platform, a scalable and open cloud service, analyzes, creates, and views digital twins of infrastructure assets. Bentley's infrastructure schema unifies and makes interoperability possible for SYNCHRO, AssetWise, and ProjectWise, which covers the complete infrastructure value chain and lifetime due to the new iTwin Platform capabilities.

Competitive Landscape

Key players operating in the Business Software Industry are –

• SAP SE

• Microsoft Corporation

• Oracle Corporation

• Rockwell Automation Inc.

• Honeywell International Inc.

• Aventri Inc.

• Sage Group, plc

• NetSuite, Inc.

• International Business Machines Corporation

• General Electric Co.

No comments:

Post a Comment