Global healthcare information systems industry data book is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

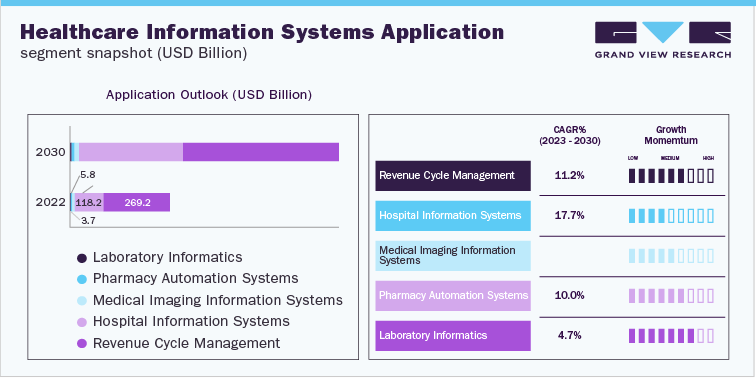

The global healthcare information systems market size generated over USD 406.4 billion in 2022 and is expected to grow at a CAGR of 13.3% over the forecast period.

Hospital Information System Market Report Highlights

The global hospital information system market was valued at USD 118.2 billion in 2022 and is anticipated to witness growth at a rate of 17.7% over the forecast period. Rising government initiatives and increasing demand from hospitals to deploy advanced IT solutions for effective operational efficiency are some of the key factors driving the adoption of hospital information systems. In addition, growing use of Electronic Health Records (EHRs) for patient-centric care is significantly boosting market growth. Furthermore, technological advancement in healthcare IT infrastructure along with increasing adoption of cloud computing in hospital settings is impelling market growth.

The hospital information system market is segmented based on type. It includes electronic health record, electronic medical record, real-time healthcare, patient engagement solution, and population health management. Population health management (PHM) dominated the market. It is driven by several key factors such as increasing government initiatives being undertaken to reduce healthcare costs, growing importance of value-based care, rising need for effective disease management, and introduction of Big Data analytics in healthcare, software, & IT solutions. In September 2020, Cerner collaborated with Hampshire and Isle of Wight (HIOW) health and care system to implement their PHM data platform, HealtheIntent along with their big data analytics solution, HealtheEDW. These tools aimed at transforming and improving the health and care delivery of the UK’s population.

Pharmacy Automation Systems Market Analysis & Forecast

The pharmacy automation systems market was valued at USD 5.8 billion in 2022 and is expected grow at a CAGR of 10.0% from 2023 to 2030. Medicine wastage is a major problem globally and costed USD 14.56 globally in 2021, with the adoption of automation in pharmaceutical sector there have been considerable reduction in wastage of medicines and increasing prescription volumes.

Increased prescription volumes have been reported due to the adoption of automation systems in retail pharmacy, with the users of automation devices such as dispensing robots reporting increase in prescription volumes up to 70%, which is attributed to positively impact the demand for the automation devices globally.

On the basis of product, the medication dispensing segment dominated the market in 2022. These systems are commonly used in medication distribution process to reduce errors in dispensing and enhance speed & accuracy. According to a research study published by Health Technology Inquiry Service, automated dispensing devices reduced dispensing and medication errors along with costs as compared to the manual systems.

Order your copy of Free Sample of “Healthcare Information Systems Industry Data Book - Hospital Information Systems, Pharmacy Automation Systems, Laboratory Informatics and Revenue Cycle Management Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Laboratory Informatics Market Analysis & Forecast

The laboratory informatics market size was valued at USD 3.7 billion in 2022. Emergence of Software as a Service (SaaS)-based laboratory information system is an example of technological advancements. Low initial cost of ownership, reduced IT cost, and rapid deployment are some of the major factors boosting the demand for SaaS-based laboratory inventory systems.

Business intelligence tools such as D360, LiveDesign, and BIOVIA Insight are leveraging through data analysis technology. These tools can interface with Electronic Laboratory Notebooks (ELNs) or Laboratory Information Management Systems (LIMS). Some of the application areas of LIMS offered by Thermo Fisher Scientific include Research and development LIMS, Process development and manufacturing LIMS, and Bioanalytical LIMS.

Revenue Cycle Management Market Analysis & Forecast

The revenue cycle management market size was valued at USD 269.2 billion in 2022 globally and is expected to grow at a CAGR of 11.2% to reach USD 634.7 billion by 2030 over the forecast period. A key driver of revenue cycles in the majority of healthcare procedures is reimbursement services from copays, health insurance payers, and insurance deductibles from patients. If a healthcare supplier's revenue cycle management is more efficient, it will be more profitable. Mishandling of insurance refunds or patient collections can hamper a provider’s monetary solvency.

Outsourcing of healthcare IT services has increased owing to various factors such as the dearth of skilled labor, shortage of resources, and rising healthcare costs. Primary services that are outsourced by healthcare organizations include coding stipulations, key performance monitoring, follow-up of claims, and ensuring data accuracy. The major advantages of outsourcing the revenue cycle management are the availability of skilled & trained professionals, cost-effective & efficient services, and compliance to required rules & regulations.

Loopholes in the healthcare infrastructure may act as a major restraint for emerging markets such as China and India. In recent years, China’s Communist Party has announced various reforms for infrastructural development in the country. Lack of supportive infrastructure restrains the growth and adoption of innovative systems such as revenue cycle management.

Competitive Landscape

Key players operating in the Healthcare Information Systems Industry are –

• athenahealth, Inc.

• Philips Healthcare

• Agfa Gevaert Group

• McKesson Corporation

• Epic Systems Corporation

• Allscripts Healthcare, LLC

• Cerner Corporation

• GE Healthcare

• Hewlett Packard

• Agfa Gevaert Group

No comments:

Post a Comment